BELLIN

-

Company

-

Specifications

-

Corporate payments

-

Cash Visibility

<

>

|

BELLIN, a Coupa company, is a global leader in treasury technology.

We cater to a range of clients from large multinationals to SMEs. BELLIN has been championing innovation and out-of-the-box thinking since 1998. With the treasury software tm5 as the centerpiece, BELLIN makes a fundamental difference by offering solutions that zero in on the relationship between corporates and banks and cover everything from cash management to payments or multilateral netting. BELLIN is an international company with offices on four continents, powered by a trailblazing fintech spirit. Vertical Divider

|

FEATURED SESSIONS

|

Treasury Solution Grid

BELLIN tm5 enables company-wide control and transparency for treasurers and finance specialists by utilising dedicated modules that provide powerful solutions.

Treasury

Cash Management + Financial Instruments

Banking

Payments + In-house Banking

Recon & Netting

IC Reconciliation + IC Netting

Liquidity Planning + Risk/FX Management

Planning & Risk

BI, Analytics, Reporting

Security

Security, Fraud, Compliance

BELLIN tm5 enables company-wide control and transparency for treasurers and finance specialists by utilising dedicated modules that provide powerful solutions.

Treasury

Cash Management + Financial Instruments

- Retrieve and process statements from any bank

- Manage and forecast group-wide cash in one system

- Record, manage and evaluate financial instruments

- Minimize the cost of funding across your group

Banking

Payments + In-house Banking

- Enter, approve and process all payments

- One platform, one login, one password – all banks

- SWIFT, H2H, domestic standards, SAP integration

- Act as an in-house bank for your group

Recon & Netting

IC Reconciliation + IC Netting

- Automate invoice reconciliation + matching

- Benefit from system notifications

- Combine multiple transactions into one

- Optimize cash management, funding + FX risk

Liquidity Planning + Risk/FX Management

- Meet liquidity needs with data-driven planning

- Counteract inaccuracies and avoid redundant funding

- Manage FX risk, interest volatility + other exposures

- Leverage risk modeling, analysis tools and trading

Planning & Risk

BI, Analytics, Reporting

- TMS-integrated BI, analytics and reporting tool

- Intuitive dashboards with real-time KPIs

Security

Security, Fraud, Compliance

- Certified cloud environment

- Multiple approval levels, 2FA, Vendor Verification

|

How Darling Ingredients Streamlined Corporate Payment Processing with SWIFT gpi for Corporates

An Optimal Recipe for Global Payments By working with BELLIN and implementing tm5, Darling aimed to achieve the following:

Hien Dijkstra, Treasurer, Darling Ingredients International Read More > |

|

|

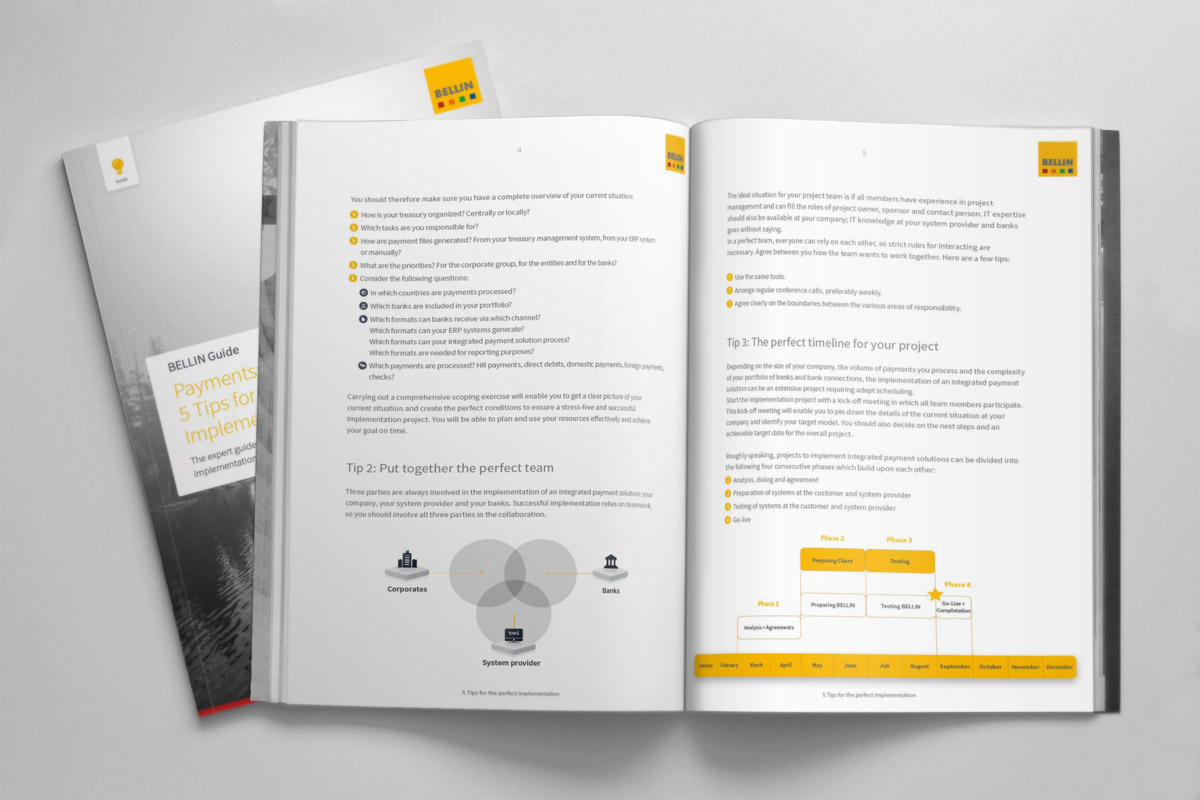

Payments: 5 Tips for the Perfect Implementation

With an integrated payments platform, companies establish efficient and secure payment processing. However, the group-wide implementation of the integrated payments solution can end up in a nightmare. This expert guide outlines 5 top tips to achieve a stress-free implementation of an integrated payment solution:

Download now> |

|

5 Steps to Secure and Reliable Payment Processes

This guide outlines the 5 key payment processing steps to:

Download now> |

|

Fact Sheet – Integrated Payment Processing for Global Corporations

This fact sheet titled: Integrated Payment Processing for Global Corporations, highlights how a centralized corporate payment solution can streamline an overcomplex global banking landscape, save ample time managing payments, and provide visibility and control of your payment processing. Download now> |

|

BELLIN SWIFT Service

This BELLIN SWIFT Service fact sheet highlights the benefits of utilizing the most expansive and powerful bank connectivity network in the world. Global companies means bank accounts spread across different countries, and an overview of cash flows and payment details might be a challenge for you. Experiencing slow and non-transparent processing of cross-border payments? Global transparency and quick and reliable payment processing is possible with the BELLIN SWIFT Service and SWIFT gpi for Corporates (g4C). This fact sheet will teach you how you can generate gpi payments directly in your treasury management system, tm5, and process gpi status messages seamlessly. Download now> |

|

Embracing Technology: Solving Key Cash Management Challenges

Examining challenges and opportunities in cash management This white paper titled: Embracing Technology: Solving Key Cash Management Challenges, highlights some of the key challenges and opportunities that treasurers should be aware of to fortify their cash management processes. Cash management is the building block of many other treasury tasks which makes it an important practice to optimize. While both existing and emerging solutions play a role in simplifying cash management, treasurers are being expected to expand their responsibilities. The solution is a combination of capable technology and intricate process analysis to establish a structure that will have a significant positive impact on your efforts as a whole. Challenges include:

|

|

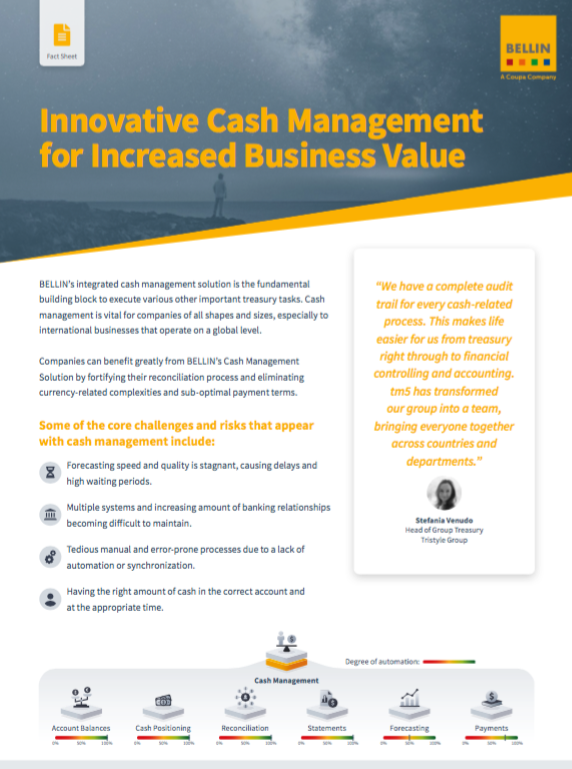

Innovative Cash Management for Increased Business Value

Centralized, automated, and real-time BELLIN’s integrated cash management solution is the fundamental building block for treasurers by allowing you to fortify your reconciliation process and eliminate currency-related complexities and sub-optimal payment terms. This fact sheet details the key challenges, benefits, and functionality of our innovative cash management solution. Download here |

|

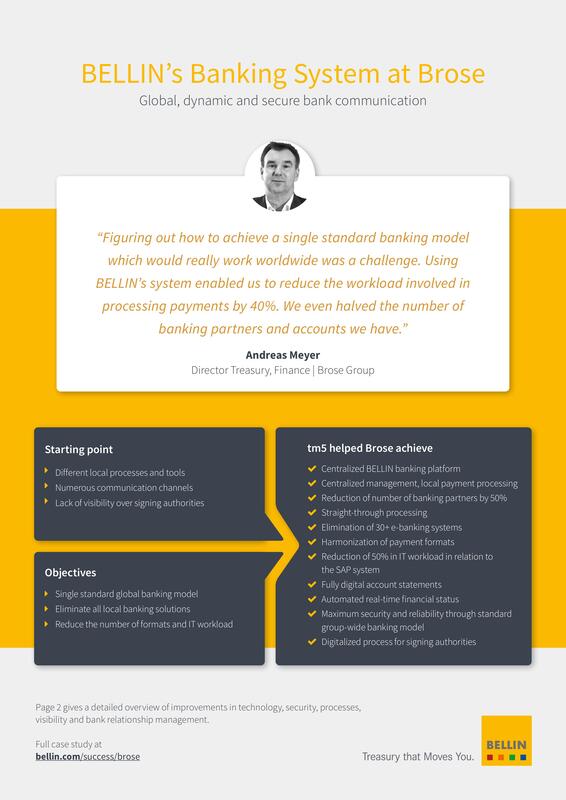

Global, Dynamic, Secure Banking for Brose Using BELLIN Technology

The MOBI project: modernization of the group’s global banking infrastructure What was achieved?

Download here |