HedgeGo

-

Company

-

Specifications

-

Resources

<

>

|

Automated data for FX decisions. Next generation.

HedgeGo helps CFOs and Treasuries with automated decision data for those areas that are influenced by foreign currencies (FX). Managing cash flows in different foreign currencies entails a fundamental challenge: protecting the balance sheet (value-at-risk) with as little effort as possible (cash flow-at-risk). This challenge can now be tackled with a new generation of FX intelligence, providing easy-to-implement decision data, that…

In other words, HedgeGo balances your cash-flow-at risk with your value-at-risk based on profound automated FX market analysis supported by latest machine learning models. Such automated always accessible FX decision data improve FX-related management and policies, reducing individual emotions on decision making and rendering a system and its policies more reliable and transparent. As a result, corporates using HedgeGo’s FX intelligence improve their overall resilience and strengthen their international competitiveness. “We had to put a great deal of effort to monitor FX markets on regular base. That took away precious time for our internal decision making processes. Now we have a FX intelligence that always keeps us on track with no effort. CFO, international retailer HedgeGo’s decision data are trusted by CFOs and Treasury leaders in corporates all around Europe. Currently, exposures in the equivalent of over 2bn Euro are controlled by decision data like CCT (Cash Conversion Timing) and BTA (Best Timing Payables). Additionally, HedgeGo provides LPOs (Loss Protection Orders) and CTAs (Call To actions) for ongoing FX-related projects. Finally, CFOs and Treasurers can use a PMA (Pressure map) in their weekly processes, running an early-warning system for short term drastic market changes in respective currency pairs. As seamless integration of services becomes a market standard, HedgeGo offers API services to transfer its proprietary information into almost every ERP or TMS (Treasury Management System) on the market. For more information, visit hedgego.com and start taking advantage of state-of-the-art FX decision data. |

FEATURED SESSIONS

|

Key Solutions and feature overview

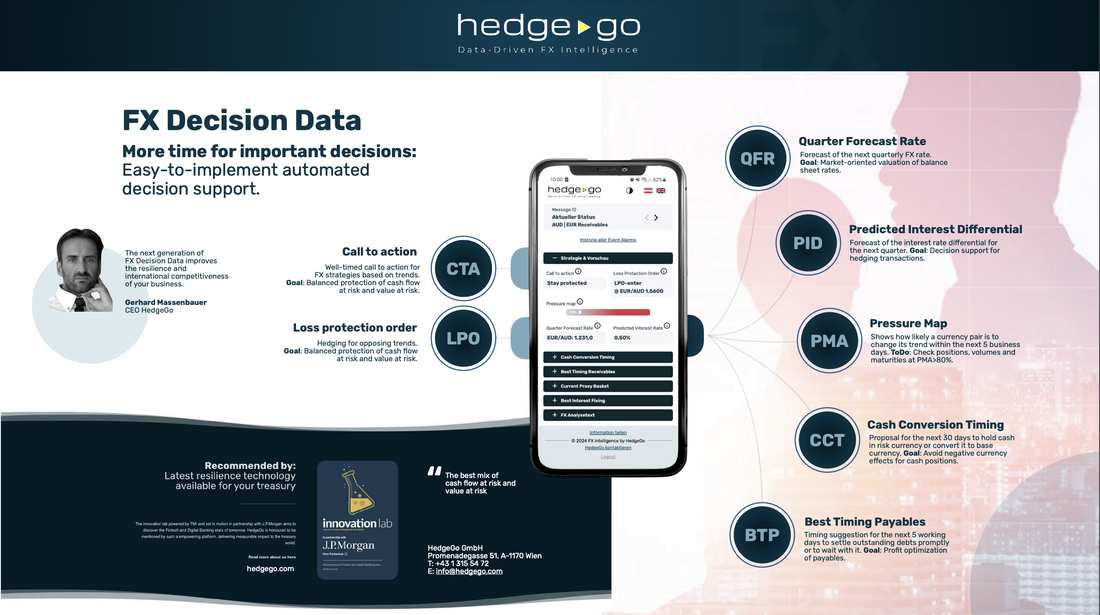

FX Pressure map (PMA)

The pressure map shows on a scale from 0% to 100% how likely a currency pair will change its trend within the next 5 business days. Goal: Check positions, volumes and maturities at PMA > 80%.

FX Call to action (CTA)

Our FX intelligence communicates well-timed calls to action based on trend changes. Such CTAs contain information like “Enter hedge”, “Stay hedged”, “Leave hedge” and “Stay protected”.

Goal: Balanced protection of cash flow at risk and value at risk.

Loss protection order (LPO)

Loss protection orders suggest a price barrier that protects the current position against an unexpected adverse development. The aim is to avoid losses from poor developments and make the most of favourable trends.

Objective: Balanced ratio of balance sheet and liquidity protection

Best timing payables (BTP)

Timing suggestion for the next 20 business days to pay open liabilities in risk currency. The terms "Pay: Pay now" and "Delay: Make payments later" provide the suggested action to use less reporting currency to buy the needed cash in foreign currencies.

Goal: Pay earlier than the payment target specifies if it offers financial advantages.

Cash Conversion Timing (CCT)

Valuation proposal for the next 20 business days to hold cash in risk currency or convert it into base currency. The terms "Hold + risk currency" and "Convert into + base currency" provide the framework for action.

Objective: Avoid negative currency effects for cash positions.

Best Timing Receivables (BTR)

Valuation proposal for the next 20 business days to assess the risk of delayed outstanding receivables in risk currency. The terms "Increased risk" and "Limited risk" define the valuation framework.

Objective: To assess the short-term risk of delayed payments from customers.

Quarter Forecast Rate (QFR)

The forecast of the next quarterly foreign exchange rate enables a dynamic and market-driven adjustment of forecasts.

Goal: Market-driven valuation of balance sheet rates.

Predicted Interest Rate (PID)

Forecasting the interest rate differential for the next quarter enables better valuation and dynamic forecasting of hedging costs. Goal: Access accurate cost forecast for hedging transactions.

Contextual FX Management

HedgeGo delivers contexual information to current decision data and allows updated communication within the corporate organisation.

FX Pressure map (PMA)

The pressure map shows on a scale from 0% to 100% how likely a currency pair will change its trend within the next 5 business days. Goal: Check positions, volumes and maturities at PMA > 80%.

FX Call to action (CTA)

Our FX intelligence communicates well-timed calls to action based on trend changes. Such CTAs contain information like “Enter hedge”, “Stay hedged”, “Leave hedge” and “Stay protected”.

Goal: Balanced protection of cash flow at risk and value at risk.

Loss protection order (LPO)

Loss protection orders suggest a price barrier that protects the current position against an unexpected adverse development. The aim is to avoid losses from poor developments and make the most of favourable trends.

Objective: Balanced ratio of balance sheet and liquidity protection

Best timing payables (BTP)

Timing suggestion for the next 20 business days to pay open liabilities in risk currency. The terms "Pay: Pay now" and "Delay: Make payments later" provide the suggested action to use less reporting currency to buy the needed cash in foreign currencies.

Goal: Pay earlier than the payment target specifies if it offers financial advantages.

Cash Conversion Timing (CCT)

Valuation proposal for the next 20 business days to hold cash in risk currency or convert it into base currency. The terms "Hold + risk currency" and "Convert into + base currency" provide the framework for action.

Objective: Avoid negative currency effects for cash positions.

Best Timing Receivables (BTR)

Valuation proposal for the next 20 business days to assess the risk of delayed outstanding receivables in risk currency. The terms "Increased risk" and "Limited risk" define the valuation framework.

Objective: To assess the short-term risk of delayed payments from customers.

Quarter Forecast Rate (QFR)

The forecast of the next quarterly foreign exchange rate enables a dynamic and market-driven adjustment of forecasts.

Goal: Market-driven valuation of balance sheet rates.

Predicted Interest Rate (PID)

Forecasting the interest rate differential for the next quarter enables better valuation and dynamic forecasting of hedging costs. Goal: Access accurate cost forecast for hedging transactions.

Contextual FX Management

HedgeGo delivers contexual information to current decision data and allows updated communication within the corporate organisation.

2024: Your FX intelligence waits for you

HedgeGo’s FX intelligence runs an automated analysis environment to deliver relevant decision data to FX treasuries.

Its Goal: to improve business resilience and competitiveness. Reinforced learning algorithms provide a condensed view of relevant developments, reduces the effort required for decisions and enables an improved balance between cashflow-at-risk and value-at-risk. Use such dedicated information to vcentralize your treasury, manage FX-influenced intercompany loans, refine forecasts, create more transparency and run simulations in order to improve policies and processes.

These videos (EN/DE) below shows how HedgeGo helps your organisation to take advantage of HedgeGo’s FX Intelligence.

HedgeGo’s FX intelligence runs an automated analysis environment to deliver relevant decision data to FX treasuries.

Its Goal: to improve business resilience and competitiveness. Reinforced learning algorithms provide a condensed view of relevant developments, reduces the effort required for decisions and enables an improved balance between cashflow-at-risk and value-at-risk. Use such dedicated information to vcentralize your treasury, manage FX-influenced intercompany loans, refine forecasts, create more transparency and run simulations in order to improve policies and processes.

These videos (EN/DE) below shows how HedgeGo helps your organisation to take advantage of HedgeGo’s FX Intelligence.

|

|

|