Kantox

-

Company

-

Resources

<

>

Start removing FX risk and embracing currenciesKantox simplifies the lives of treasurers and CFOs with software that automates the complex and time-consuming currency management process. Start empowering your financial teams by transforming how you manage FX risk and conduct cross-border business.

Since its establishment in 2011, Kantox has garnered the trust of clients across 75 countries. Its innovative platform covers the entire FX process, from accurately pricing products and services with real-time exchange rates to effectively hedging currency risk and optimising cash management. As a secure and scalable SaaS platform, Kantox leverages automation to transform the FX workflow, providing multinational corporations worldwide with the tools they need to maximise growth opportunities, mitigate potential FX losses, and significantly reduce operational costs. In October 2022, BNP Paribas signed an agreement for the acquisition of Kantox. Kantox will continue to operate as an independent company, now with the experience and market power of BNP Paribas behind it. The acquisition is subject to regulatory approvals and is expected to be completed in the coming months. Get in touch and discover how your company can eliminate FX risk Contact Kantox: [email protected] Vertical Divider

|

FEATURED SESSIONS

|

|

Kantox Dynamic Hedging® Automate your entire FX risk management process with a single software solution

Discover Kantox Dynamic Hedging®, an award-winning SaaS solution that allows treasurers and CFOs to effectively remove FX risk and increase profitability by leveraging currencies. Use Kantox Dynamic Hedging® to perform end-to-end automation, integrating real-time exposure management, rules-based hedge execution, reporting and analytics. Customise easy-to-use dashboards and obtain instant visibility on all aspects of your currency hedging. Learn more here |

|

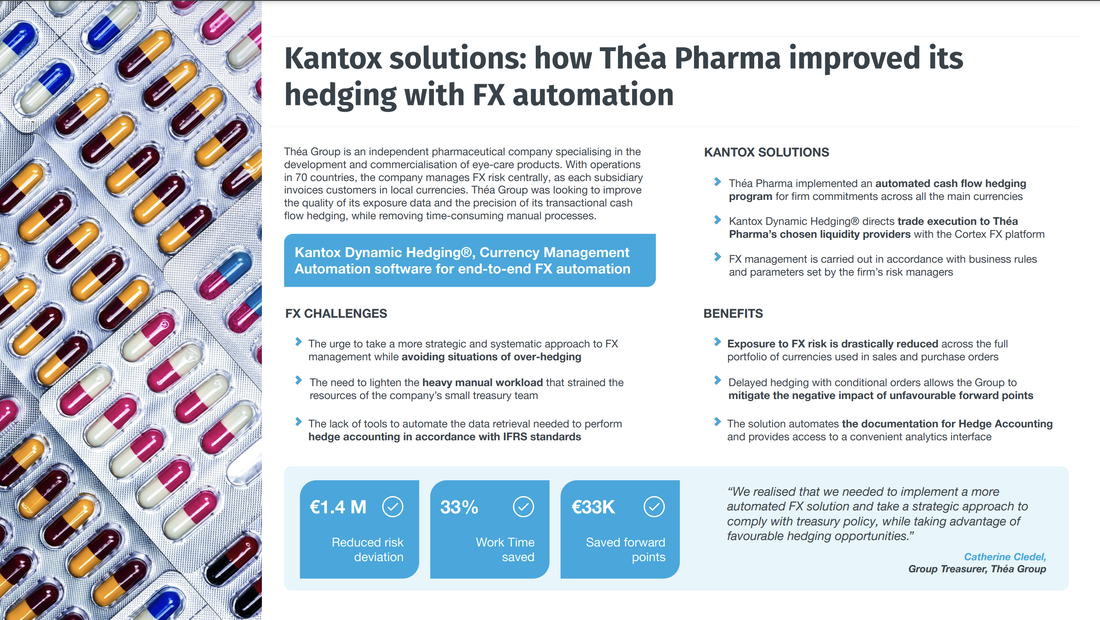

How Théa Pharma improved its hedging with automation

Théa Group was looking to improve the quality of its exposure data and the precision of its transactional cash flow hedging while removing time-consuming manual processes. Discover how Kantox helped it achieve €1.4 million in reduced risk deviation and saved €33,000 in forward points. Download case study here |

|

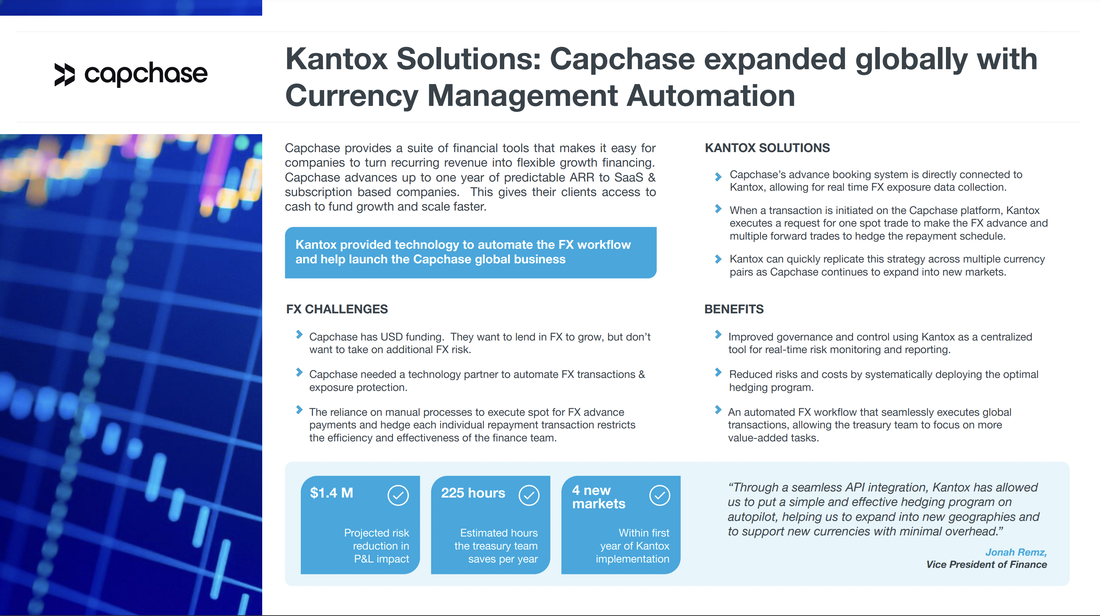

How Capchase expanded globally with Currency Management Automation

Capchase, a US-based fintech, wanted to start lending in FX to grow its business without taking on any additional FX risk. Find out how it expanded to four new markets within one year of implementing Kantox. Download Case Study here> |