Trustmi

-

Company

-

Specifications

-

Values

-

Resources

<

>

|

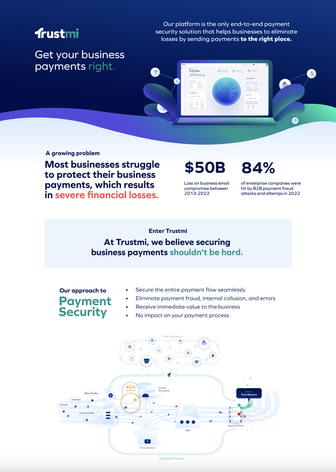

In 2023, Trustmi emerged from stealth mode with its official launch as a pioneering leader in business payments security. Trustmi is the only end-to-end business payment security solution that helps companies protect their bottom line by eliminating losses from cyberattacks, internal collusion, and human error by ensuring payments go to the right place.

Trustmi features a number of unique factors the sets it apart in today’s market. Trustmi’s solution takes a holistic approach to securing invoice payments and fund-transfers by connecting information and activity across siloed financial systems. The solution captures a full view of the payment data flow and analyzes hundreds of data points to uncover vulnerabilities and eliminate threats. Trustmi takes a highly quantitative approach to preventing payment losses to deliver immediate value to customers. The Trustmi team can set up, calibrate, and deploy the platform within one week. By conducting an initial assessment of past payments quickly, Trustmi shows how the platform can deliver rapid value to finance teams and effectively secure B2B payments, mitigate losses, and drive bottom-line growth immediately after deployment. By leveraging AI, Trustmi detects issues, prevents incidents, predicts fraud, and accelerates the payment process. Trustmi’s advanced technology detects abnormal payment activities through machine learning and identifies risks to predict potential future issues. The platform accelerates the payment flow by removing manual work, from onboarding and approval through to funds release. With Trustmi, businesses can evolve from unsecure manual validation of their B2B payments to full AI automation to secure their fund transfers. Trustmi’s flexible solution layers seamlessly onto existing ERPs and other financial systems, and folds easily into finance teams’ current processes to boost efficiency and reduce manual work. Trustmi customers have full control of their workflows so that they can run their payment process their way without any changes or interruptions. Additionally, the Trustmi team boasts deep expertise and experience in all aspects of cybersecurity, fintech, and payments tech, and combines best practices from all these disciplines to create a unique approach to securing business payments and supporting our customers’ success. Trustmi has achieved strong success with global enterprises and distinguished Fortune 500 companies, including CNA Insurance and Colgate-Palmolive Company, among others. Vertical Divider

|

FEATURED SESSIONS

|

Finance and Treasury teams that leverage Trustmi’s solution gain confidence in their business payments process knowing they are successfully eliminating fraud and errors to protect their bottom line. With Trustmi, businesses can:

• Gain visibility into the payment process, from vendor onboarding to payments release.

• Enjoy increased efficiency with a modern and automated payment cycle approval flow.

• Remove manual effort in vendor creation and change processes.

• Provide a payments risk assessment for each transaction throughout the payment flow

• Offer a new and advanced approach to bank account validation and securing vendor financial documents.

A Comprehensive Payment Security Solution

Trustmi's flexible and modular platform offers finance teams and treasurers the ability to use only the tools they need for securing their payment processes and managing their vendors.

MODULES

Payment Approval Workflow

This module gives teams transparency across the payment process. It uncovers vulnerabilities with the payment workflow, detects suspicious signals, and secures your payments. Most importantly, the module provides payment protection without causing changes or interruptions to existing workflows, and folds easily into the current payment process also providing automation to reduce manual work.

Vendor Onboarding

Our solution transforms vendor onboarding within the procure-to-pay process to remove the labor-intensive work that can result in errors and to protect vendor information from fraudsters. We offer a tailored self-service platform that streamlines vendor enrollment and fully validates vendor payment details and files.

Vendor Lifecycle Management

This module enables businesses to manage vendors in one centralized place. Businesses can easily update vendor information and manage their profile changes. Additionally, the module enables businesses to configure and manage access levels, vendor payments and timing for payment cycles. Once a vendor contract expires or if a vendor change is needed, companies can easily offboard and remove vendors using this tool.

SOX Compliance

This module helps finance teams and treasurers to comply with SOX regulations effortlessly, simplify audit preparations and reduce manual work through automation. By leveraging this feature, finance and treasury practitioners can establish financial reporting standards, protect their data, monitor attempted breaches, avoid violations and prove compliance, freeing up internal resources from spending time on SOX compliance.

Claim Fraud Engine

Avoiding claims fraud and errors can be very challenging. This module secures payments for insurance claims and reimbursements, ensuring the right claimant is paid the right amount. Finance and treasury teams gain transparency into the approval and payment workflow for claims and can manage claims and claimants in one central location to eliminate fraud and errors.

Trust Network

Trustmi's unique Trust Network unites powerful collective intelligence across millions of vendors and businesses to maximize protection for business payments. With a large number of vendors participating in the network, Trustmi can monitor and validate changes in vendor profiles and automatically alert businesses if a threat actor is impersonating their vendor or attempting to hijack payments. This added layer of protection for businesses sets Trustmi apart as a full-stack solution for not simply detecting but also predictively eliminating future fraud incidents.

• Gain visibility into the payment process, from vendor onboarding to payments release.

• Enjoy increased efficiency with a modern and automated payment cycle approval flow.

• Remove manual effort in vendor creation and change processes.

• Provide a payments risk assessment for each transaction throughout the payment flow

• Offer a new and advanced approach to bank account validation and securing vendor financial documents.

A Comprehensive Payment Security Solution

Trustmi's flexible and modular platform offers finance teams and treasurers the ability to use only the tools they need for securing their payment processes and managing their vendors.

MODULES

Payment Approval Workflow

This module gives teams transparency across the payment process. It uncovers vulnerabilities with the payment workflow, detects suspicious signals, and secures your payments. Most importantly, the module provides payment protection without causing changes or interruptions to existing workflows, and folds easily into the current payment process also providing automation to reduce manual work.

Vendor Onboarding

Our solution transforms vendor onboarding within the procure-to-pay process to remove the labor-intensive work that can result in errors and to protect vendor information from fraudsters. We offer a tailored self-service platform that streamlines vendor enrollment and fully validates vendor payment details and files.

Vendor Lifecycle Management

This module enables businesses to manage vendors in one centralized place. Businesses can easily update vendor information and manage their profile changes. Additionally, the module enables businesses to configure and manage access levels, vendor payments and timing for payment cycles. Once a vendor contract expires or if a vendor change is needed, companies can easily offboard and remove vendors using this tool.

SOX Compliance

This module helps finance teams and treasurers to comply with SOX regulations effortlessly, simplify audit preparations and reduce manual work through automation. By leveraging this feature, finance and treasury practitioners can establish financial reporting standards, protect their data, monitor attempted breaches, avoid violations and prove compliance, freeing up internal resources from spending time on SOX compliance.

Claim Fraud Engine

Avoiding claims fraud and errors can be very challenging. This module secures payments for insurance claims and reimbursements, ensuring the right claimant is paid the right amount. Finance and treasury teams gain transparency into the approval and payment workflow for claims and can manage claims and claimants in one central location to eliminate fraud and errors.

Trust Network

Trustmi's unique Trust Network unites powerful collective intelligence across millions of vendors and businesses to maximize protection for business payments. With a large number of vendors participating in the network, Trustmi can monitor and validate changes in vendor profiles and automatically alert businesses if a threat actor is impersonating their vendor or attempting to hijack payments. This added layer of protection for businesses sets Trustmi apart as a full-stack solution for not simply detecting but also predictively eliminating future fraud incidents.

Trustmi stands out in the market due to several key factors.

Connecting the dots with data:

Trustmi’s solution takes a holistic approach to securing invoice payments and fund-transfers by connecting information and activity across siloed financial systems. The solution captures a full view of the payment data flow and analyzes hundreds of data points to create a baseline for each vendor. This approach enables the platform to uncover future vulnerabilities and eliminate threats.

A rapid road to value:

Trustmi takes a highly quantitative approach to preventing payment losses to deliver immediate value to customers. The Trustmi team can set up, calibrate, and deploy the platform within one week to start protecting business payments at lightning speed.

No changes to the payment process:

Trustmi’s flexible solution layers seamlessly onto existing ERPs and other financial systems, and folds easily into finance teams’ current processes to boost efficiency and reduce manual work. Trustmi customers have full control to use only the tools they need and can run their payment process their way without any changes or interruptions.

AI Powered Self-Learning Cycle

By leveraging AI, Trustmi detects issues, prevents incidents, predicts fraud, and accelerates the payment process. Trustmi detects abnormal payment activities through machine learning and identifies the risks to predict potential future issues. The platform accelerates the payment flow by removing manual work, from onboarding and approval through to funds release. Businesses can evolve from unsecure manual validation of their B2B payments to full AI automation to secure their fund transfers.

Deep fintech and cyber experience:

The team has deep expertise and experience in all aspects of cybersecurity, fintech, and payments tech, and combines best practices from all these disciplines to create a unique approach to securing business payments and supporting our customers’ success. By conducting an initial assessment of past payments, Trustmi shows how the platform can deliver rapid value to finance teams and effectively secure B2B payments, mitigate losses, and drive bottom-line growth immediately after a simple deployment.

Connecting the dots with data:

Trustmi’s solution takes a holistic approach to securing invoice payments and fund-transfers by connecting information and activity across siloed financial systems. The solution captures a full view of the payment data flow and analyzes hundreds of data points to create a baseline for each vendor. This approach enables the platform to uncover future vulnerabilities and eliminate threats.

A rapid road to value:

Trustmi takes a highly quantitative approach to preventing payment losses to deliver immediate value to customers. The Trustmi team can set up, calibrate, and deploy the platform within one week to start protecting business payments at lightning speed.

No changes to the payment process:

Trustmi’s flexible solution layers seamlessly onto existing ERPs and other financial systems, and folds easily into finance teams’ current processes to boost efficiency and reduce manual work. Trustmi customers have full control to use only the tools they need and can run their payment process their way without any changes or interruptions.

AI Powered Self-Learning Cycle

By leveraging AI, Trustmi detects issues, prevents incidents, predicts fraud, and accelerates the payment process. Trustmi detects abnormal payment activities through machine learning and identifies the risks to predict potential future issues. The platform accelerates the payment flow by removing manual work, from onboarding and approval through to funds release. Businesses can evolve from unsecure manual validation of their B2B payments to full AI automation to secure their fund transfers.

Deep fintech and cyber experience:

The team has deep expertise and experience in all aspects of cybersecurity, fintech, and payments tech, and combines best practices from all these disciplines to create a unique approach to securing business payments and supporting our customers’ success. By conducting an initial assessment of past payments, Trustmi shows how the platform can deliver rapid value to finance teams and effectively secure B2B payments, mitigate losses, and drive bottom-line growth immediately after a simple deployment.

|

At Trustmi we believe securing business payments shouldn't be hard.

Our platform is the only end-to end payment security solution that helps businesses to eliminate losses by sending payments to the right place. Find out more here. |

|

Trustmi - The platform for Finance

Every company is mitigating core systems and adding new tools to meet the ever growing business needs and address finance departments challenges. Find out more here |

Trustmi - Videos

Find out all about Trustmi - and meet our Co-founder and CEO.

Find out all about Trustmi - and meet our Co-founder and CEO.

|

|

|