KYRIBA

-

Company

-

Resources

<

>

|

Kyriba empowers CFOs, Treasurers, and their IT counterparts to transform how they optimize financial technology solutions, de-risk ERP cloud migration, and activate liquidity as a dynamic, real-time vehicle for growth and value creation.

With 2,000 clients worldwide, including 25 percent of Fortune 500 and Eurostoxx 50 companies, Kyriba’s pioneering Connectivity as a Service platform integrates internal applications for treasury, risk, payments and working capital with vital external sources such as banks, ERPs, trading platforms, and market data providers. Kyriba is a secure, scalable SaaS platform that leverages artificial intelligence, automates payments workflows, and enables thousands of multinational corporations and banks to maximize growth opportunities, protect against loss from fraud and financial risk, and reduce operational costs. Kyriba is headquartered in San Diego, with offices in Dubai, Frankfurt, London, Minsk, Paris, Shanghai, Singapore, Tokyo, Warsaw and other major locations. For more information, visit www.kyriba.uk |

FEATURED SESSIONS

|

|

Kyriba Risk Management

Gain insight into how currencies are impacting financial results and cost-effectively manage FX exposure and risk. READ MORE > |

|

Activate Liquidity

Transform how you use liquidity as a dynamic vehicle for growth and value creation. The Power to Manage Liquidity, Enterprise Wide CFOs have had a tough balancing act: How to pursue strategic growth initiatives, while still minding risk? What’s needed is a strategic approach to treasury and finance that elevates the impact of liquidity to generate new value by gaining greater control over its uses— especially in volatile markets. We call this Enterprise Liquidity Management. READ MORE > |

|

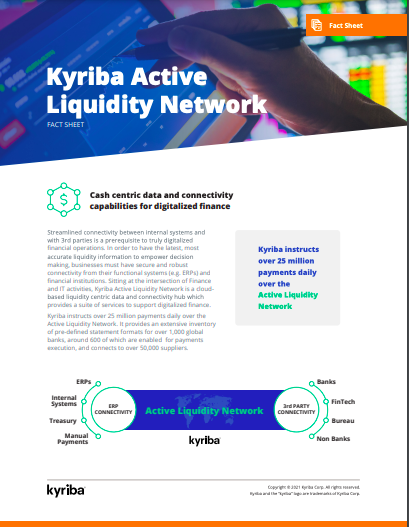

Kyriba Enterprise Liquidity Management Platform

The Kyriba Enterprise Liquidity Management Platform connects systems, applications and data that strengthens an organization’s capability to improve financial performance. This unifies best-in-class treasury, risk management, payments and working capital solutions with external partners, including global banks, market data providers, trading platforms and third-party applications. READ MORE > |

|

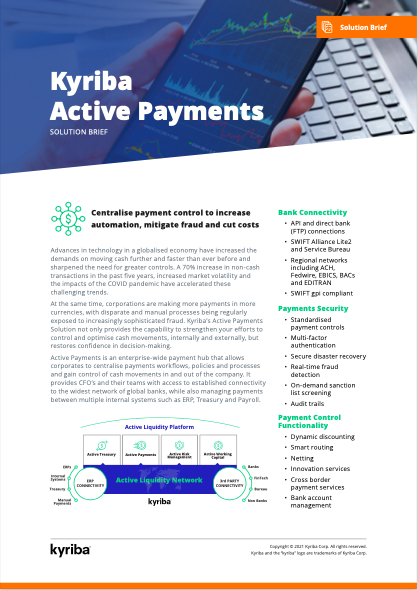

Kyriba Active Payments

Kyriba Active Payments is an enterprise-wide payment hub that allows corporates to centralize payments workflows, policies and processes and gain control of cash movements in and out of the company. It provides CFO’s and their teams with access to established connectivity to the widest network of global banks, while also managing payments between multiple internal systems such as ERP, Treasury and Payroll. READ MORE > |