COUPA

-

Company

-

Specifications

-

Corporate payments

-

Cash Visibility

-

Fraud & Cybercrime

<

>

|

With nearly $1.5 trillion of cumulative spend under management across its global customer base, Coupa offers all businesses – from Fortune 1000 companies to the world’s fastest growing organizations – the visibility and control needed to manage costs, mitigate risks, and scale for growth in one comprehensive and open cloud-based platform. With the extensive data flowing through Coupa, Community Intelligence uniquely offers real-time benchmarks and best-practice prescriptions that are tested against the measurable outcomes of companies around the world.

Coupa’s Business Spend Management (BSM) Platform empowers finance and procurement leaders to spend smarter and tap into the collective wisdom of the Coupa Community. Join us to upend your spend today. For more information, visit www.coupa.com Vertical Divider

|

FEATURED SESSIONS

|

Coupa Treasury Key Capabilities

|

Cash and Liquidity Management

|

Risk and Exposure Management

|

|

Debt and Investment Management

|

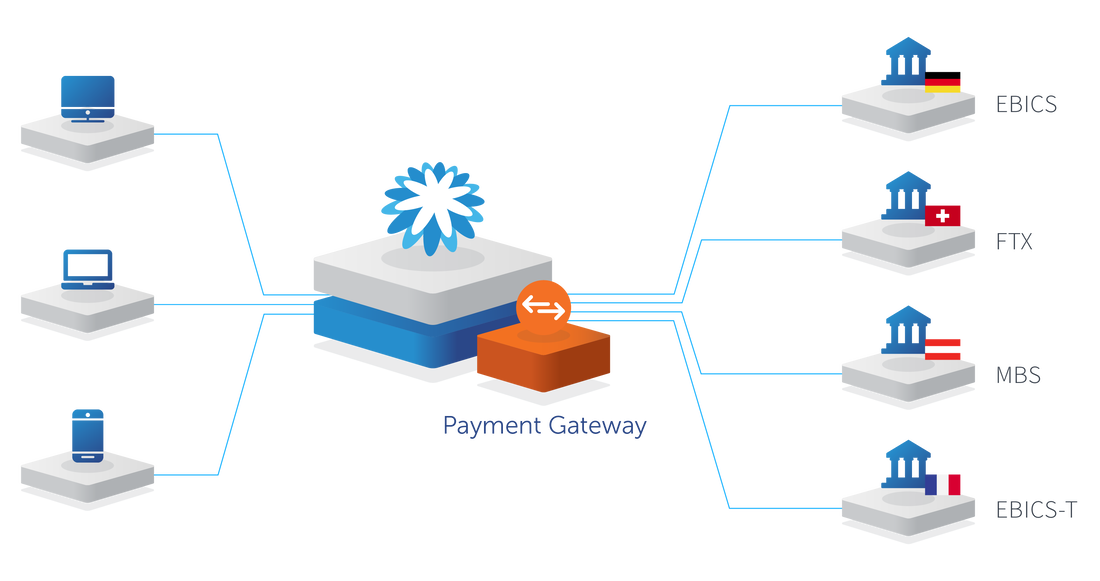

Bank Connectivity and Payments

|

|

Forecasting

|

Reporting

|

|

Intercompany Netting

In-house Banking

|

Security, Fraud and Compliance

|

|

Empower Payment Security with a Multi-bank TMS

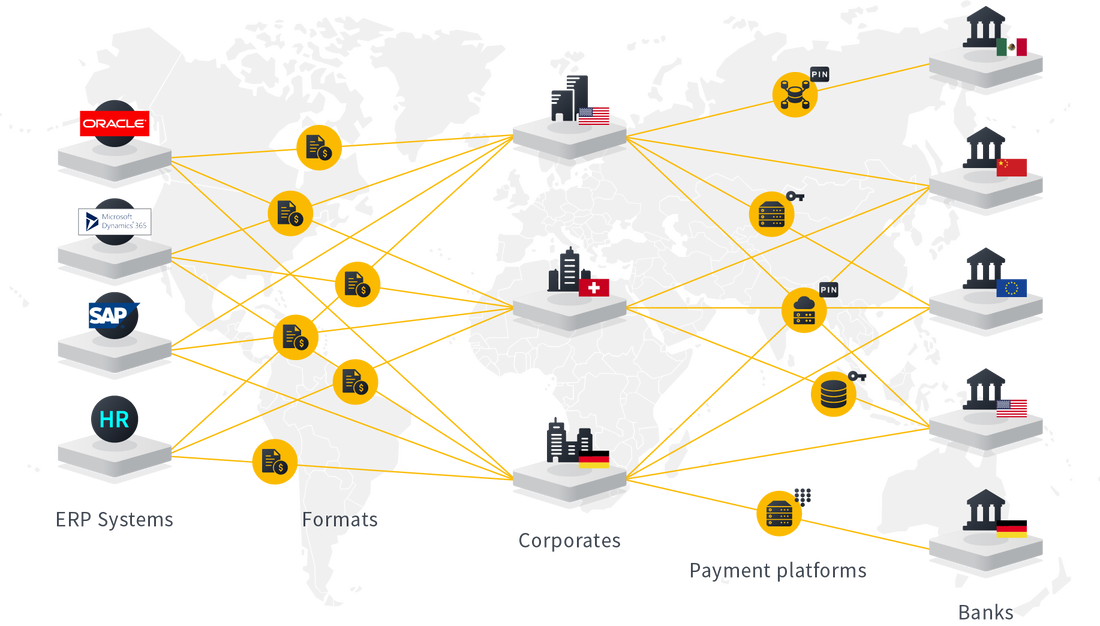

Fortifying Payment Security with a TMS We examine a typical international company that has several subsidiaries with treasury departments that have only a few staff. This company faces the major challenge of capturing complex data and at the same time meeting extensive payment security requirements. Chaos vs. visibility

Payment Security in Treasury – At a glance:

Read more> |

|

How to Solve the 4 Main Payments Challenges

Coupa Treasury consultants have collected years of experience working with implementation projects, scoping workshops, and much more of hands-on experience working with real treasurers. One topic of which is payments and payment implementation projects. We have gathered some of the key questions they have addressed over the years. Here are some key challenges we have noticed.

Read more> |

|

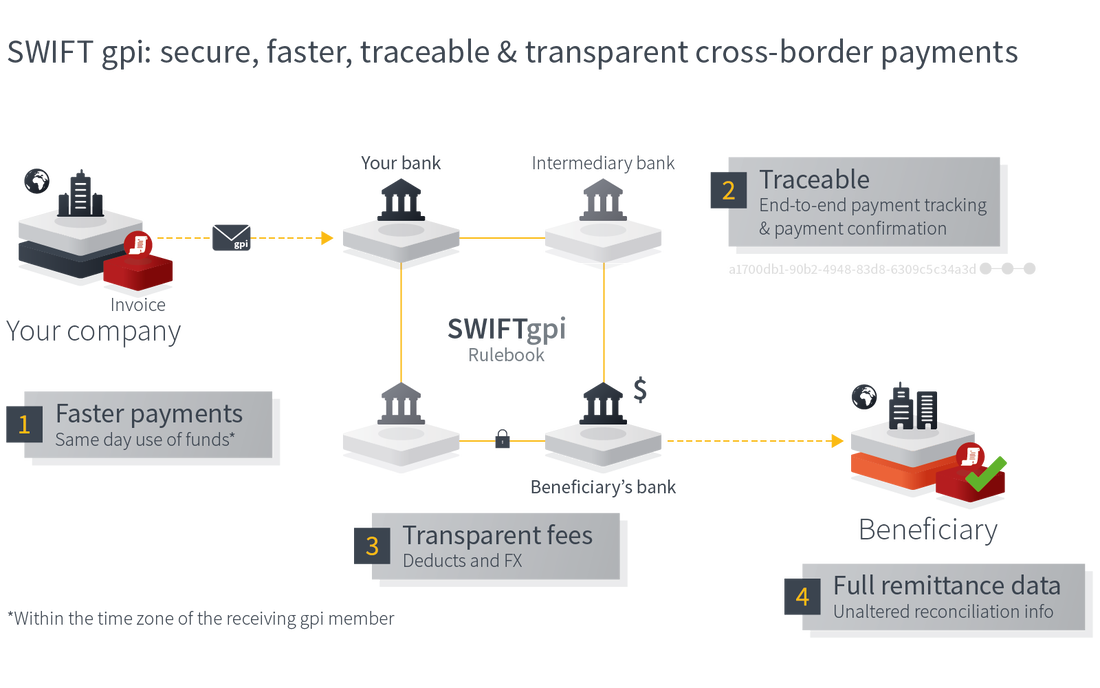

SWIFT gpi: Innovation in Global Banking

Inscrutable networks of banks and reference banks for processing cross-border payments stand in the way of treasurers achieving efficiency and transparency. The SWIFT gpi (global payments innovation) project addresses this issue by offering a new and fast method for processing and tracking payments. Information about banks and financial institutions involved, transfer and crediting times, reference IDs as well as specific fees is available in real time. We take a closer look at the project: Where do we currently stand? How does an integrated solution benefit treasury? And how will this innovation impact treasury? Challenges in cross-border payments

Read more> |

|

Defining 6 Core Cash Management Challenges and Solutions

Read more> |

|

Cash Management and the Role in Treasury

Cash management is arguably the most important treasury management discipline. For many treasurers, this doesn’t even merit an extra mention. However, cash management is a complex subject that can potentially make or break a company; it does deserve a more detailed examination. What is cash management and how can I find the optimum setup for my business?

|

|

6 Vendor Fraud Prevention Tips (Infographic)

Without proper prevention strategies, fraud can be costly and difficult to detect. We look at the best way of preventing this. Read more> |

|

Payment Fraud: Assessing and Responding to an Escalating Threat Know what you're up against to develop fast, effective responses to cybercrime in treasury Your Role in Managing Payment Security To guard organizational liquidity effectively, treasury bears a responsibility to keep watch over all elements that affect payment security, even if those elements don't fall within treasury's mandate. To lead your organization's tactics, you must stay on top of news in the war on fraud. Our recent eBook in collaboration with Strategic Treasurer can help. Download the eBook and you will:

Download here> |

|

Navigating your way through Cybersecurity

Take stock of your cyber defenses and play an active role in preventing and mitigating cybercrime in treasury Understand What "More Secure" Means to You and Map Your Journey There Cybercrime is everywhere, and it’s evolving. This guide helps treasurers like you take action to protect your organization’s “crown jewels” and create a secure technical environment as well as day-to-day processes. Learn more about what you can do now and how the right partner can help. After reading this guide, you'll know:

Download here> |