Cobase

-

Company

-

Specifications

-

Bank Account Management

<

>

Multibanking made simple.Vertical Divider

“Our mission is to make working with multiple banks more efficient. This process is never finished, every day we make it easier.”

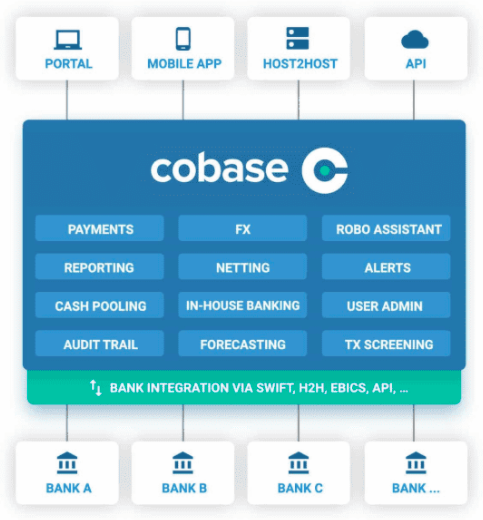

Cobase offers a Multibank platform for Corporates, that helps to manage their bank accounts with many different banks. Companies that hold accounts with different banks face many inefficiencies. They have to use different bank portals to interact with their banks and other financial service providers, and often multiple ERP connections have to be maintained. The more different banks and accounts a company has, the more complex it gets. Cobase offers a solution! Our multibank platform is a single point of access to all bank accounts and other financial products and services from many banks and financial service providers. Main features of the platform are a:

The combination of this functionality with many bank connections in one place offers tremendous financial and operational efficiency, especially for medium and large size companies. Users and authorisation schemes can be centrally managed for all subsidiaries or departments and only one security token is needed for each user. For enquiries, please contact: [email protected] Find out here > |

FEATURED SESSIONS

|

|

Vertical Divider

Cobase ISAE 3402 Type 2 and SOC2 Type 2 certified

Being certain that payments and client data are always safe with Cobase is our top priority. Certification is an important aspect to assure high quality security management processes are in place. Cobase is ISO 27001 certified as well as ISAE 3402 Type 2 and SOC2 Type 2 certified. These certifications provide our customers and other stakeholders the assurance that Cobase manages its systems and processes in a responsible manner. Cobase holds payment service provider license from the Dutch Central Bank and is backed by three strong shareholders (ING Bank, Nordea and Credit Agricole Corporate and Investment Bank). This strongly differentiates us from other solution providers. |

|

Corporates use Cobase to manage their bank accounts at many different banks. Our platform can connect with almost every bank in the world.

The most important features on the platform are a payment hub with configurable payment formats, powerful account reporting with balance and transaction information, and a flexible user administration. Alerts can be sent via email or sms. Transaction screening is implemented to assure compliance and as part of integral risk management. A Robo Assistant and In-House Bank solution are also available. We have recently released new modules for Liquidity Forecasting and FX Risk Management (including auto-hedging). Modules for Cash Pooling and Loan Portfolio Management are on our roadmap for 2021. Find out here > |