Payable

-

Company

-

Specifications

<

>

Cash control for modern finance teamsPayable is a treasury management platform for scaling finance teams. We connect live banking data to ERP and finance tools to give our clients full control over their treasury and cash operations. Our platform helps finance teams save time and drive efficiencies with multi-entity accounting and reporting, reconcile the accounting entry across the banking and finance stack and instruct vendor payments at scale without compromising on security.

Teams use Payable to cut 70% of their manual work with custom reconciliation rules, set payment approvals for compliant payouts and gain real-time cash visibility across all their entities and currencies from a single dashboard. Our most-loved products and features are:

|

FEATURED SESSIONS

|

|

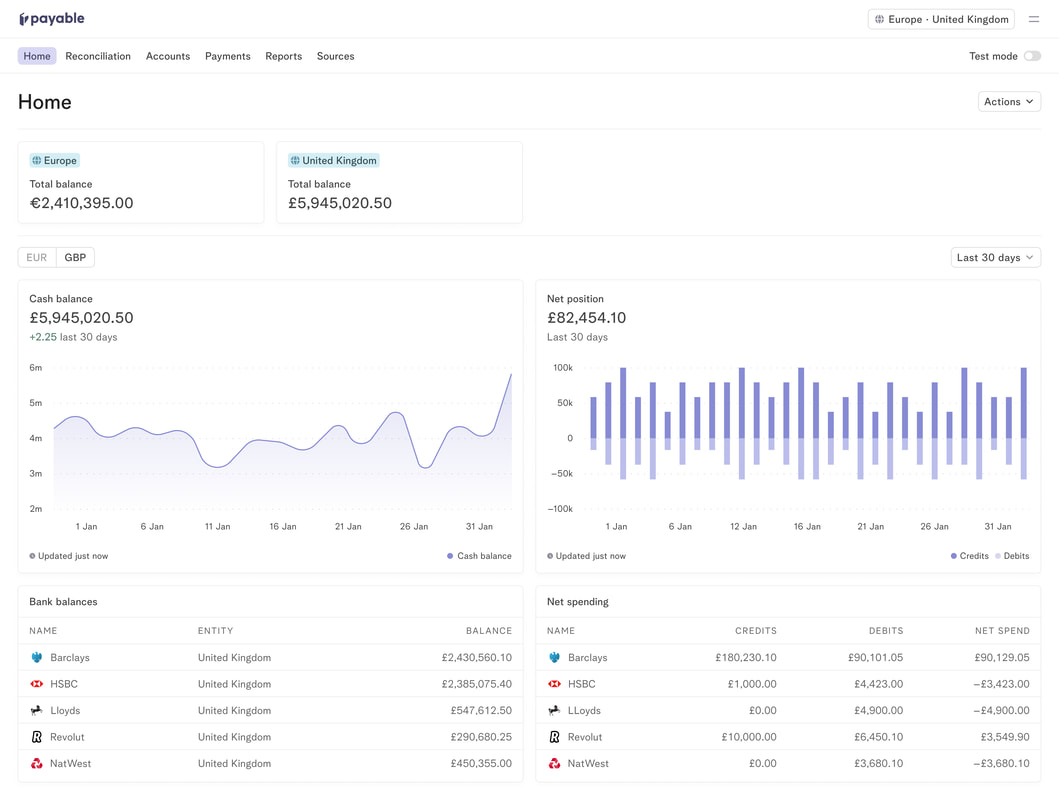

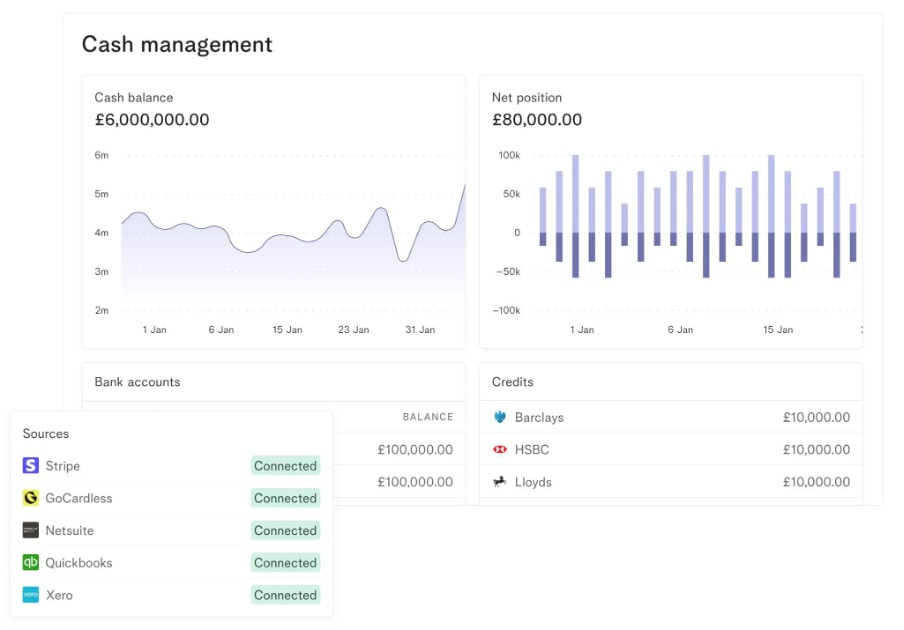

Cash management: Centralise your banking ecosystem and get real-time global cash visibility.

Our Cash management module gives you a single dashboard to track live cash balances across all of your accounts, entities and currencies.

|

|

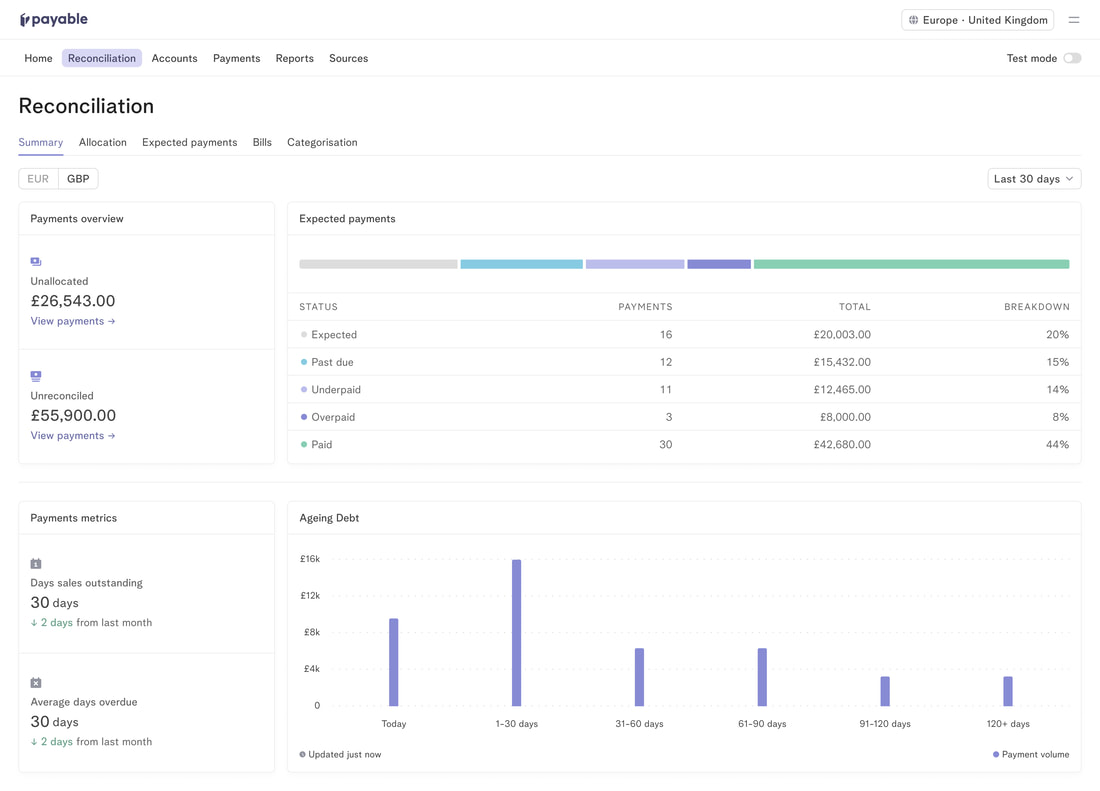

Reconciliation: Turn operations into automations.

Our Reconciliation module consolidates all your data sources, allowing you to track what is owed, what has been paid and accelerate your month-end close.

|

|

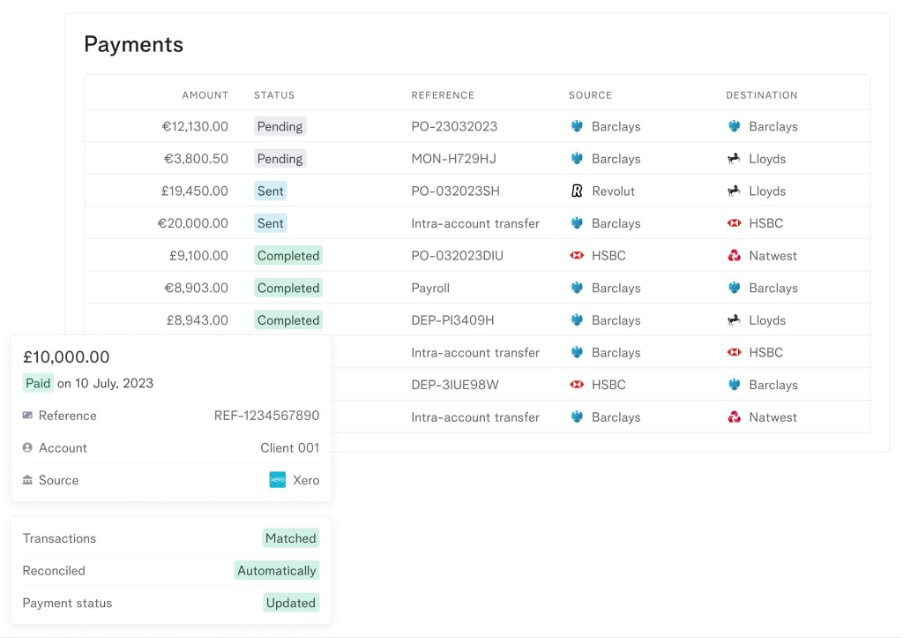

Payments automation: Speed up payment runs by automatically instructing payments at scale.

Our Payments automation module automates your payment instructions directly from Payable. We connect with your bank and ERPs so you can easily automate vendor payments without building and maintaining complex integrations.

|