TreasuryXpress

-

Company

-

Specifications

-

Corporate Payments

-

Cash Visibility

<

>

|

TreasuryXpress, a global leader in on-demand treasury management solutions, has removed the cost-prohibitive and time-consuming barriers of automation for 170+ treasuries worldwide.

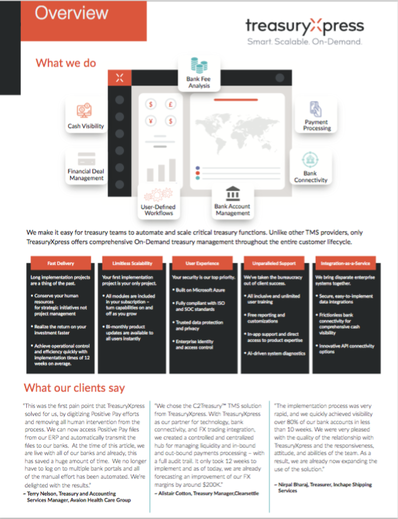

TreasuryXpress offers the most economic, easy-to-implement and easy –to use, digital cloud-based treasury management software in the industry. Companies of all sizes can leverage our solutions to automate and optimize their finances on-demand and in the cloud. TreasuryXpress’ on-demand TMS solution, helps clients easily connect to banks to achieve optimal cash and liquidity management. The solution also helps securely manage end-to-end payment processing. User-friendly, self-service reporting tools allow for easy access and distribution of critical financial reports. Key capabilities include Daily Treasury Operations, Real-time Cash Management and Visibility, Bank Connectivity & Bank Account Management, Liquidity Management and Working Capital, Financial Deal (Investment and Debt) Management, Payments Management & Security, Workflow and Connectivity Optimization, In-House Banking, Cash Accounting, Bank Fee Analysis, Custom Dashboards and Reporting. Vertical Divider

|

FEATURED SESSIONS

|

Optimize payments and reduce risk

The workflow for electronic payments often involves multiple systems, multiple people across multiple departments, and manual processes and/or manual intervention(s) by one or more parties which can introduce many points of vulnerability and exposure to payment fraud attacks

TreasuryXpress helps mitigate payment risk by offering highly secure, streamlined payments workflows for domestic and cross-border payments which remove manual and inefficient processes and systems from current workflow. Functionality includes:

The workflow for electronic payments often involves multiple systems, multiple people across multiple departments, and manual processes and/or manual intervention(s) by one or more parties which can introduce many points of vulnerability and exposure to payment fraud attacks

TreasuryXpress helps mitigate payment risk by offering highly secure, streamlined payments workflows for domestic and cross-border payments which remove manual and inefficient processes and systems from current workflow. Functionality includes:

- Virtual tokens

- Electronic signature workflow

- Full audit trail for every transaction

- Transaction matching capabilities

- FBI Watchlist matching

|

TreasuryXpress - Overview

TreasuryXpress makes it easy for treasury teams to automate and scale critical treasury functions. Unlike other TMS providers, only TreasuryXpress offers comprehensive On-Demand treasury management throughout the entire customer lifecycle. Download here to find out more > |

|

Holiday Inn Club Vacations - Case study

Planning for “what ifs” paid dividends when COVID-19 hit vacation industry. Download to read the full case study www.treasurydragons.com/uploads/1/0/7/8/10788161/treasuryxpress_casestudies_final.pdf> |

|

TreasuryXpress - Imagine yourself in this situation.

Watch now> |

|

|

The Smart, Scalable, and On-Demand Treasury Management Solution

Built for speed, efficiency, and scalability, TreasuryXpress’ on-demand TMS model significantly eliminates manual processes and improves control throughout all stages of treasury management. With rapid and cost-effective implementation times, TreasuryXpress is putting an end to “treasury blind-spots” by taking treasury teams beyond the boundaries of spreadsheets and legacy TMS solutions Download here to find out more > |

|

What we do

We make it easy for treasury teams to automate and scale critical treasury functions. Unlike other TMS providers, only TreasuryXpress offers comprehensive On-Demand treasury management throughout the entire customer lifecycle. Download here to find out more > |

|

|